Contrave will likely be REJECTED The FDA is expected to release the final decision on Monday Jan. 31, 2011 regarding the marketing clearance of Orexigen's late-stage diet pill, Contrave (combination of bupropion and naltrexone). If passed, Contrave will be the first FDA-approved weight loss drug in more than a decade. Based on the limited effectiveness of Contrave in cutting body weight compared to the placebo ('sugar pill') in addition to the adverse effects found associated with the new medicine in the clinical trials, I maintain my belief that the HIGH risk-to-benefit ratio does not warrant an approval from the agency. The FDA's request for extra birth defect information on Friday from Orexigen's close competitor, Vivus, concerning the company's investigational diet drug, Qnexa, sent Vivus' shares down more than 16%, dragging down Orexigen's shares along the way. It is difficult to imagine that the drug regulator will let ANY weight loss pills pass easily at this moment!

Low to high risk call/put options combo

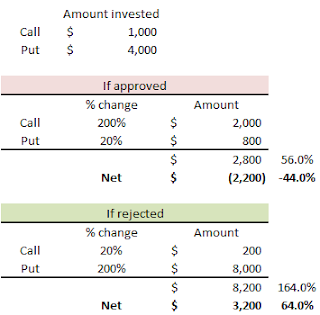

I came up with 3 call/put options combo that can be used based on the individual's comfort level toward risk. Essentially, we would purchase BOTH call and the put options and, depending on FDA's announcement, there will be 3 different outcomes.

1) Low risk (low return) --> 8% loss vs. 28% gain

2) Medium risk (medium return) --> 44% loss vs. 64% gain

3) High risk (high return) --> 80% loss vs. 100% gain

I didn't specify the price of the call/put options because the % change will be similar more or less regardless of the options price. The exact price will depend on the timing of purchase. If you are risk-adversed, then go with combo #1. However, the information that Contrave is likely to be rejected may substantially 'lower' the risk of combo #3, thereby making it the best choice?

Note: FDA may release the announcement anytime between now and Monday Jan. 31, 2011, and therefore one should consider purchasing these options some time around this coming Wednesday Jan. 26, 2011.

No comments:

Post a Comment